Confused about the credit note format? You’re not alone! Learn everything you need to know, from understanding debit vs credit notes to processing them in your accounting software. Find free downloadable templates in various formats (Word, Excel, PDF) to fit your needs, including those compliant with GST! Discover when to issue a credit note, explore different types, and see how they differ from tax invoices. Even correct errors with ease!

Whether you’re dealing with returns, discounts, or bad debt, credit notes are crucial for businesses. They help with GST compliance and record keeping and even come in handy for refunds. Luckily, there are free generators and software to create credit notes in various formats, including PDF and Excel, ensuring they comply with FTA and GST rules in Saudi Arabia or anywhere you operate.

Contents

Credit Note

A tax invoice is issued when two parties establish a transaction between themselves. The supplier generates a tax invoice with all the necessary details for the buyer and the buyer makes the payment. To put it simply, the ownership of goods and products gets transferred from the seller to the buyer. However, due to multiple reasons, a supplier needs to refund a partial or full during the transaction process. Because the original invoice cannot be deleted or edited once it is issued, the supplier has to issue a business credit note for the buyer to keep the accounting records intact.

Example

Suppose, two parties namely Star Ltd. (the buyer) and Steering Ltd.(the supplier) had a transaction on 21st April 2021. The products ordered by Star Ltd. situated in Delhi were worth 400000/- Indian rupees. Steering Ltd. who also has an office in Delhi issued a tax invoice worth rupees 400000/- and the payment was cleared on the same day. After the delivery of the goods, Star Ltd. found out that goods worth 50000/- were not up to the mark and decided to return the products. Steering Ltd. must generate a credit note for Star Ltd. for returning the goods. The amount that needs to be repaid is equivalent to the aggregate value of the goods and services.

A credit note is the answer to your transactional troubles.

The rule suggests the amount equivalent to the goods or services returned needs to be refunded to the buyer’s account. The same clause also suggests that to relieve the buyer of the tax liability a credit note needs to be attached with the invoice. Here, the credit note will act as an affirmation of the amount that needs to be returned to the buyer. Multiple invoices can use a single credit note, so there is no particular need to issue credit notes every time a tax invoice is generated.

Furthermore, if and when credit notes are generated, the individual or company whomsoever it may concern needs to declare the details while filing for the GST report on the following month.

Under the CGST Act Section 32, registered individuals can generate a tax invoice, therefore unregistered traders cannot ask for taxes while supplying goods and services.

When to Issue a Credit Note

After the implementation of Goods and Service Tax laws in 2015, it has been specified in which circumstances a credit note can be issued. Some of them are discussed below:

- When the goods have been purchased the tax paid by the buyer is more than the actual amount.

- If the payment is yet to be made, but the receiver of the products or services finds out that the tax implied on the product is more than legitimate value.

- The supplier needs to refund a partial or full amount (depending upon the situation) if the buyer returns the product due to the poor quality of the goods or services.

- If any similar or tends to similar reasons arise during the transaction process.

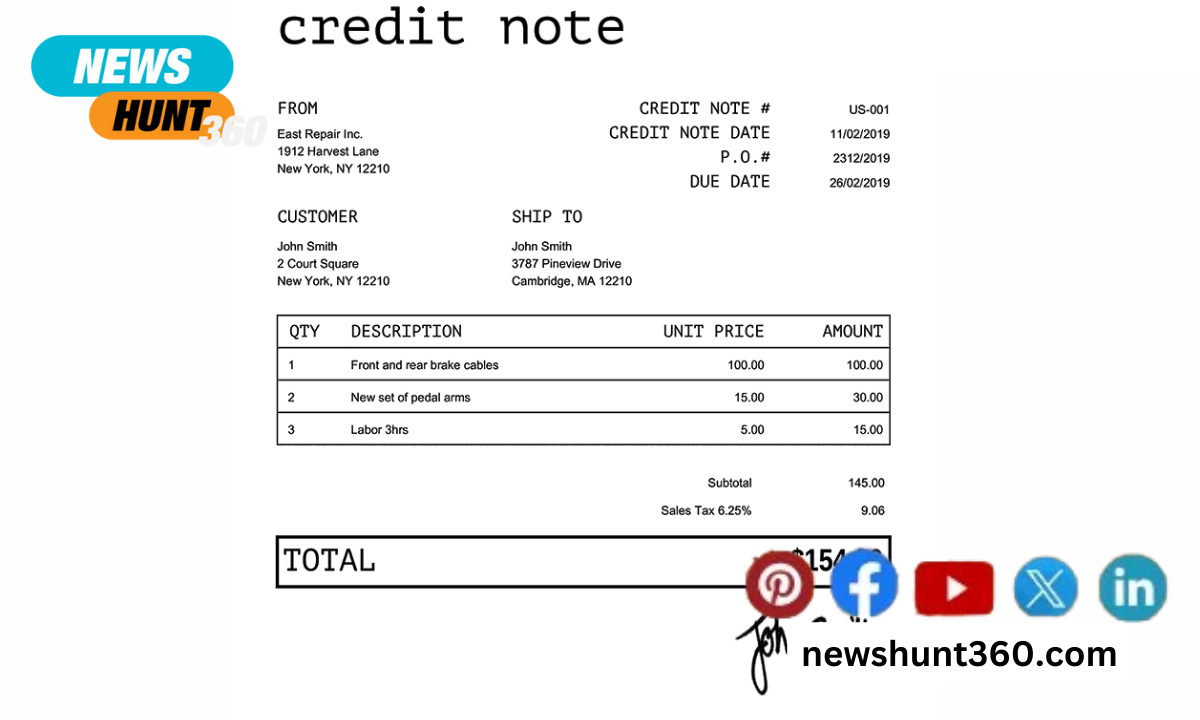

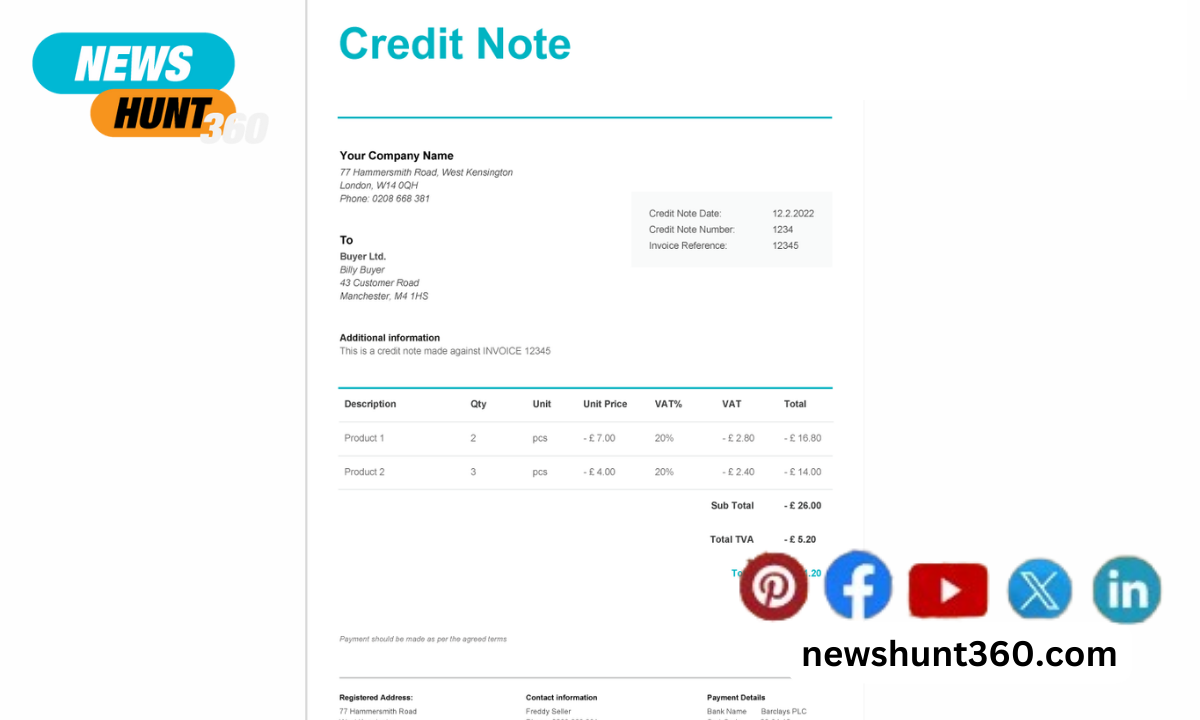

Details that Need to be Covered While Creating a Credit Note

A dealer must keep some essential details while generating a credit note format:

- Date: When the transaction occurs, the date of the transaction needs to be declared.

- Header: One of the basic aspects of the credit report is to denote the document type (i.e, credit note)

- Serial Number: A credit note must possess a unique 16-digit consecutive serial number. You can include a combination of alphabet, numerical, and special characters.

- Contact Details: The contact details of the supplier in addition to the Goods and Service Tax Identification Number.

- Supplier Details: Supplier’s name, address, and GST number.

- Invoice Details: Include the date of issue, invoice number, and the details of the invoice to avoid confusion.

- Amount: All monetary details of the invoice including tax rate, the value of the product or services, and the taxable amount credited or debited from the receiver.

- Verification: Don’t forget to include the signature of the supplier or his/her authorized representative.

Credit Note Format

While creating a credit note format, keep these details in mind:

- Supplier’s GSTIN (Goods and Service Tax Identification Number), name and address.

- Document Type (credit note)

- Buyer name, address, GSTIN, or Unique ID number (if registered under the GST law).

- In case the buyer is unregistered please mention the name, address, address of delivery place, state, and Pincode of the person who is going to receive the goods.

- Invoice number and date of the invoice.

- Tax cost and amount of the goods or services.

- Issued date of the credit note.

- The buyer must include a unique and consecutive number system of 16 digits in the credit note.

- Lastly, the credit note format must have the signature or digital signature of the supplier or his/her respective representative.

Keeping all these details in mind is necessary while creating a credit note format. Without these details a credit note is incomplete.

It would be interesting if you also knew about the best credit card machines and terminals.

Conclusion

In essence, a credit note acts as a formal record of a financial adjustment to a previous invoice. It serves to reduce the customer’s outstanding balance due to returns, errors, or price discrepancies. While there’s no single prescribed format, key elements like the company details, credit note number, date, and reason for issuance ensure clarity and proper record-keeping.