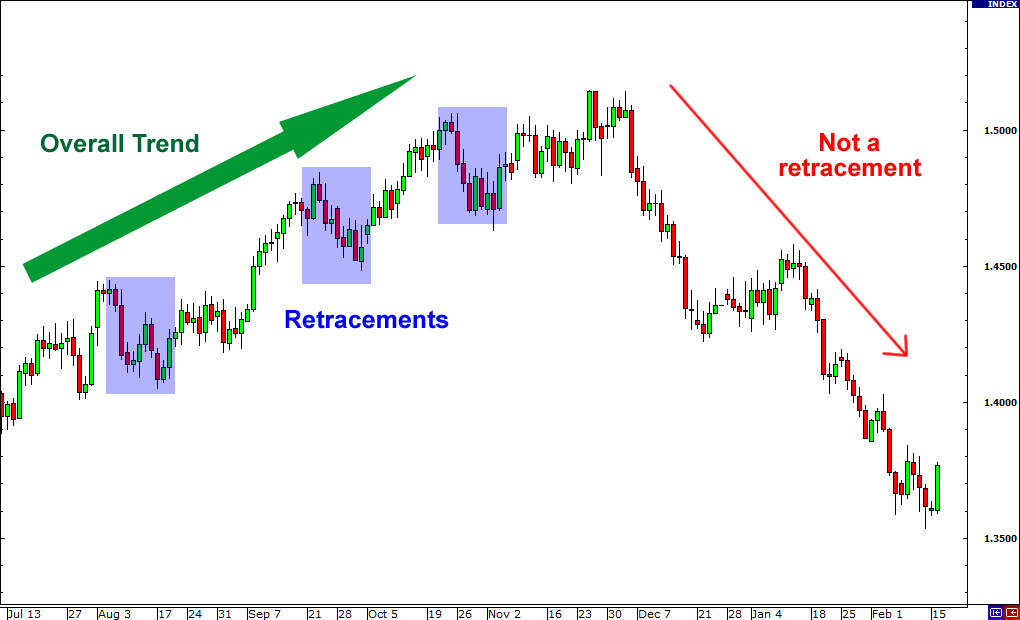

It’s important to understand that reversal different From retracement when it comes to reversal or retracement in cryptocurrency trading. In short, reversal is when the market moves against the prevailing trend, while retracement is a temporary pause within that trend. In the dynamic world of trading, understanding retracement vs pullback is crucial. Retracement, often mistaken for a reversal, signifies a temporary pause before the prevailing trend resumes.

Utilizing Fibonacci retracement and technical analysis aids in identifying retracement in forex. Distinguishing between trend reversal and price retracement enhances trading strategy, as accurate recognition of market reversal patterns provides valuable trading signals. Engaging in price action reversal analysis empowers traders in navigating the complexities of the financial markets.

In the dynamic world of trading, understanding “retracement vs correction” is key. A “retracement,” a temporary reversal within a trend, differs from a correction, which is a more profound trend reversal. Identifying these with “Fibonacci retracement” and candlestick patterns enhances your “retracement trading strategy.” Recognizing support and resistance levels is crucial for successful “swing trading.” Whether it’s a bullish reversal or bearish retracement, grasp the nuances for effective trend continuation in forex.

Contents

Unlocking the World of Forex Reversals and Trading Dynamics

Ever wondered, “What is a reversal in forex?” Reversal occurs when a price trend changes direction. Now, about retracement in trading—it’s a temporary reversal within a trend. Enter Fibonacci retracement, a tool based on the Fibonacci sequence. Compare retracement vs correction; the former is short-term, the latter more profound. Explore Elliott Wave Theory for price trend dynamics. Factor in trading psychology, watch price momentum and utilize reversal indicators amidst chart patterns. Master these, and you’re on your trading A-game.

In the world of cryptocurrency trading, understanding the nuances of market movements is crucial. Reversal, different from retracement, signifies a complete trend shift, while retracement is a temporary pullback. LATOKEN, a prominent exchange, facilitates seamless crypto transactions. Automated crypto trading robots, a rising trend, simplify trading with their efficient algorithms.

Reversal Vs. Retracement: Reversal Different From Retracement Overview

Reversal can signify that the market is about to change direction, while retracement may be a sign of consolidation or exhaustion within the trend. Understanding the difference between these two concepts is essential for successful cryptocurrency trading.

When it comes to reversal candlestick patterns, there are many different ones that traders can watch for. The Hammer, Shooting Star, and Inverted Hammer exemplify reversal candlesticks. These patterns can be used to help traders determine when a trend is about to reverse.

On the other hand, retracements are usually represented by a series of lower highs and lower lows. It can be seen on a price chart as a temporary pullback within the prevailing trend. Retracements can signify that the market is becoming overbought or oversold and may be preparing to reverse.

Conversely, retracement candlestick patterns typically form during a sustained trend and can be used to indicate a potential reversal. The Three White Soldiers and the Three Black Crows are two retracement candlesticks.

The Synergy of Reversal and Retracement Indicators

It’s important to remember that neither reversal nor retracement should be used as standalone indicators. Rather, they should be used with other technical indicators and analyses to help you make more informed trading decisions. By understanding the difference between these two concepts, you’ll make more educated guesses about where the market is heading next.

In the world of financial markets, understanding the dynamics of Reversal Different From Retracement is crucial. Webull Options Trading App offers a user-friendly platform for exploring Cryptocurrency Trading. Despite their differences, both share the common goal of maximizing investment opportunities.

What is a Reversal?

A reversal is a move in the opposite direction of the prevailing trend. For example, if the market has been trending upwards, a reversal would be a move downwards.

Reversals can occur in any time frame, from intra-day to long-term. They are often seen as signs that the market is about to change direction.

Below find a detailed explanation of the reversal candlestick patterns;

1. Hammer

The Hammer is a bullish reversal candlestick pattern that typically forms at the bottom of a downtrend. It is named for the small body and long lower shadow that it creates.

The Hammer indicates that the bears could not push the price any lower and that buyers are starting to take control. As such, it can be used as a buy signal.

2. Shooting Star

The Shooting Star is a bearish reversal candlestick pattern that typically forms at the top of an uptrend.

The Shooting Star indicates that the bulls could not push the price any higher and that sellers are starting to take control. As such, it can be used as a sell signal.

3. Inverted Hammer

The Inverted Hammer is a bullish reversal candlestick pattern that typically forms at the top of a downtrend.

The Inverted Hammer indicates that the bears could not push the price any lower and that buyers are starting to take control. As such, it can be used as a buy signal.

4. Three White Soldiers

The Three White Soldiers is a bullish reversal candlestick pattern that typically forms during a sustained uptrend. It is named for the three consecutive bullish candles that form the way.

The Three White Soldiers indicates that the buyers are in control and that the uptrend is likely to continue. As such, it can be used as a buy signal.

5. Three Black Crows

The Three Black Crows is a bearish reversal candlestick pattern that typically forms during a sustained downtrend. It is named for the three consecutive bearish candles that form the pattern.

The Three Black Crows indicate that the sellers are in control and that the downtrend is likely to continue. As such, it can be used as a sell signal.

What is Retracement?

A retracement is a temporary pause within the prevailing trend. For example, if the market has been trending upwards, a retracement may be a pause or pullback in that upward trend. Retracements can occur on any time frame, from intra-day to long-term. They are often seen as a sign of consolidation or exhaustion within the trend.

Generally, reversals are seen as more significant than retracements, representing a change in trend. However, it’s important to note that not all reversals result in a new trend emerging; sometimes, the market will reverse back to where it came from.

Likewise, not all retracements lead to the existing trend; sometimes, the market will resume its original trend after a brief pause.

Indicators and Analysis Techniques to Use.

It’s important to use a variety of indicators and analysis techniques to determine whether a reversal or retracement is likely and to time your trades accordingly. Price action, volume, trendlines, and moving averages can all be useful tools in this regard.

Some of the indicators and analysis techniques include;

a. Price action

Price action is observing a security’s price movement to find patterns. It includes charting techniques, such as trendlines, support and resistance levels, candlestick patterns, and more.

b. Volume

Volume is the number of shares or contracts that have been traded over a given period. It can be used to measure the strength of a trend or to confirm reversals and retracements.

c. Trendlines

Trendlines are a graphical tool used to identify trends in price data. A trendline can be drawn between two points of data and is often used to determine whether a security is in an uptrend or downtrend.

d. Moving Averages

A moving average is a technical indicator that smooths out price data by plotting the average price of a security over a given period. It can be used to indicate the trend direction and strength and reversals and retracements.

e. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum indicator that measures the speed and change of price movements. It can be used to identify overbought and oversold conditions, as well as reversals and retracements.

By using a variety of indicators and analysis techniques, you’ll be able to assess better whether a reversal or retracement is likely and make more profitable trades.

Wrapping Up

Cryptocurrency traders should always be aware of the possibility of reversals and retracements, as this provides profitable trading opportunities. It’s important to understand the difference between these two concepts to make informed trading decisions.