The way money stuff works has changed a lot because of technology. Now, we can do things like use our phones to pay for stuff and do banking on the internet. There’s also this new thing called blockchain and cryptocurrencies. Advancements like these simplify and enhance the safety measures for banks in handling our finances. However, they also introduce a level of complexity due to the various types of monetary services available. AI avatars act as digital personas capable of engaging in natural conversations with actual individuals. People want more from banks, and the rules about money are always changing too.

Contents

The role of AI avatars in Financial Institutions

A cool and new tech that can help with the money challenges we talked about is called artificial intelligence (AI), especially something called AI avatars. AI avatars are like digital characters that can naturally talk to real people. They use language and speech, just like us. These AI avatars can be super helpful for banks in a few ways:

Making customers happier: They can talk to people in a way that feels personal and friendly, making the experience better.

Teaching people about money: They can give info about money stuff in a way that’s easy to understand, helping more people learn about it.

Helping banks make more money: They can make the services banks provide work better and faster, which means more money for the banks.

These AI avatars are like friendly digital helpers that can make dealing with money easier and better for everyone.

Virtual Financial Advisors

AI avatars in banks play a big role as virtual money helpers. They act like financial advisors or consultants but in a digital form. These AI avatars can give advice and guidance to customers based on what they need and like.

They utilize sophisticated technology such as natural language processing (NLP) and machine learning (ML) to comprehend and analyze a customer’s financial status. This involves aspects like their income, expenditures, assets, and debts. Additionally, they assess an individual’s risk tolerance and investment timeline.

The avatars then use tech tricks like natural language generation (NLG) and speech synthesis to create and share suggestions. They might recommend the best way to spread out investments, the smartest strategy for investing, or the right money product or service for a person. So, these AI avatars are like digital money experts helping folks make better financial choices.

Providing Investment Advice and Portfolio Management

AI avatars serve as virtual financial advisors, providing valuable assistance in investment strategies and portfolio management. They prove particularly beneficial for individuals lacking the time, expertise, or self-assurance to navigate these financial realms independently.

There are some smart techniques these AI avatars use, like:

Reinforcement learning: This is machine learning that learns by trying things out, making mistakes, and getting rewards or penalties. It helps the avatars achieve goals, like making more money while taking fewer risks.

Genetic algorithms: These are like optimization helpers. They imitate how nature selects the best solutions over time. The avatars use this to create and improve portfolios based on their performance.

Neural networks: This is a tech inspired by how our brains work. The avatars use layers of connected nodes, like artificial neurons, to learn from data. They use this learning to do tricky tasks, like predicting what might happen in the future or sorting things into different groups.

With these clever methods, AI avatars can be good at helping people invest their money wisely and manage their portfolios well.

AI Techniques

AI avatars proficiently employ smart AI techniques to assist individuals in managing their investments and portfolios. Here’s how they accomplish this:

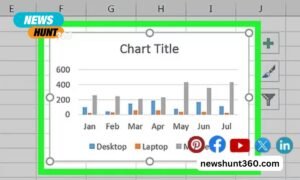

Crafting and refining portfolios: These avatars adeptly determine the optimal combination of assets—such as stocks, bonds, and funds—aligned with a customer’s preferences and requirements. They leverage this information to create portfolios tailored to the customer’s financial objectives.

Monitoring portfolios: AI avatars continue to actively observe and analyze portfolio performance. They assess earnings, gauge risk levels, and evaluate the correlations between different assets. When necessary, they make adjustments to optimize portfolio performance.

Clarifying portfolios: AI avatars possess excellent communication skills. They provide clear and straightforward reports and feedback regarding an individual’s portfolio. This encompasses summarizing the portfolio, analyzing its performance, and elucidating the rationale behind specific choices. This approach enables customers to comprehend the status of their finances effectively.

In a nutshell, these AI avatars use their smarts to create, watch over, and explain portfolios to help people make the most of their investments.

Fraud Detection and Security

AI avatars also play a big part in keeping our money safe by helping spot and stop things like fraud and bad activities.

Finding and warning about fraud:

The avatars keep an eye on all the data and actions of customers and transactions. They look at things like how much money is involved, how often transactions happen, and where they take place. If something seems fishy, they raise a flag and let the bank know.

Stopping fraud in its tracks:

The avatars make sure that the people and devices involved in transactions are who they say they are. They might use things like voice, face, or fingerprint recognition to make sure it’s all legit. If something seems off, they’ll put a stop to it and block the bad stuff.

Checking into and solving fraud:

If fraud does happen, the avatars dig into the info and evidence. They use tech tricks like understanding natural language to figure out what’s going on. Then, they account ort actions to fix things—like getting in touch with the customer, freezing the account, or reporting the problem.

In a nutshell, these AI avatars are like digital security guards, using their smarts to keep an eye out for anything fishy and making sure our money stays safe from fraud and bad activities.

Operational Efficiency

AI avatars are like helpful assistants in banks, not just for money stuff but also for making things run smoother and faster. The avatars can change scanned or printed text, like documents or forms, into digital text using smart image processing and pattern recognition. For tasks that follow clear rules and are routine, like entering data or checking information, the avatars can do it all by themselves.

They use software robots or bots to get the job done without needing constant human input. The avatars can read and understand information from different sources like data, images, or text. They use clever tech like natural language processing and machine learning to make sense of it all. This helps them generate natural-sounding language, making communication easy.

Regulatory Compliance

AI avatars also have an important job in making sure everything banks do follows the rules and laws of the financial world. AI avatars can store and understand all the rules and regulations that govern the financial world. They use clever tech like knowledge representation and reasoning to apply these rules to the data and activities of the banks, making sure everything stays within the lines.

The avatars can read and understand the rules and regulations written in normal language. They use natural language processing to interpret these rules and then generate language that complies with them. This helps in making sure everyone understands and follows the rules.

AI avatars don’t just stop at knowing the current rules; they keep learning. If there are changes or updates to the rules, they adapt and improve. They use machine learning to learn from data and feedback and reinforcement learning to stay on top of any changes in the rules and regulations.

Conclusion

AI avatars are making a big difference in the money world, bringing lots of good things to both banks and customers. AI avatars talk to people in a way that feels personal and friendly. This makes dealing with money more enjoyable and satisfying. AI avatars make it easy for everyone to learn about money. They provide info and education that’s clear and makes sense so more people can get in on the money game.

And guess what? One of the coolest AI avatars out there is DeepBrain’s AI avatar. It’s super advanced and aims to create a digital character that looks and acts like a real person.

This initiative marks a groundbreaking advancement in creating lifelike and interactive digital characters, thereby enhancing the overall customer experience significantly.

Thank you for taking the time to read this blog. Wishing you a joyful, healthy, and wonderful day ahead!